avalara tax codes by state

Due to varying local sales tax rates we strongly recommend using. Total rate range 4-9.

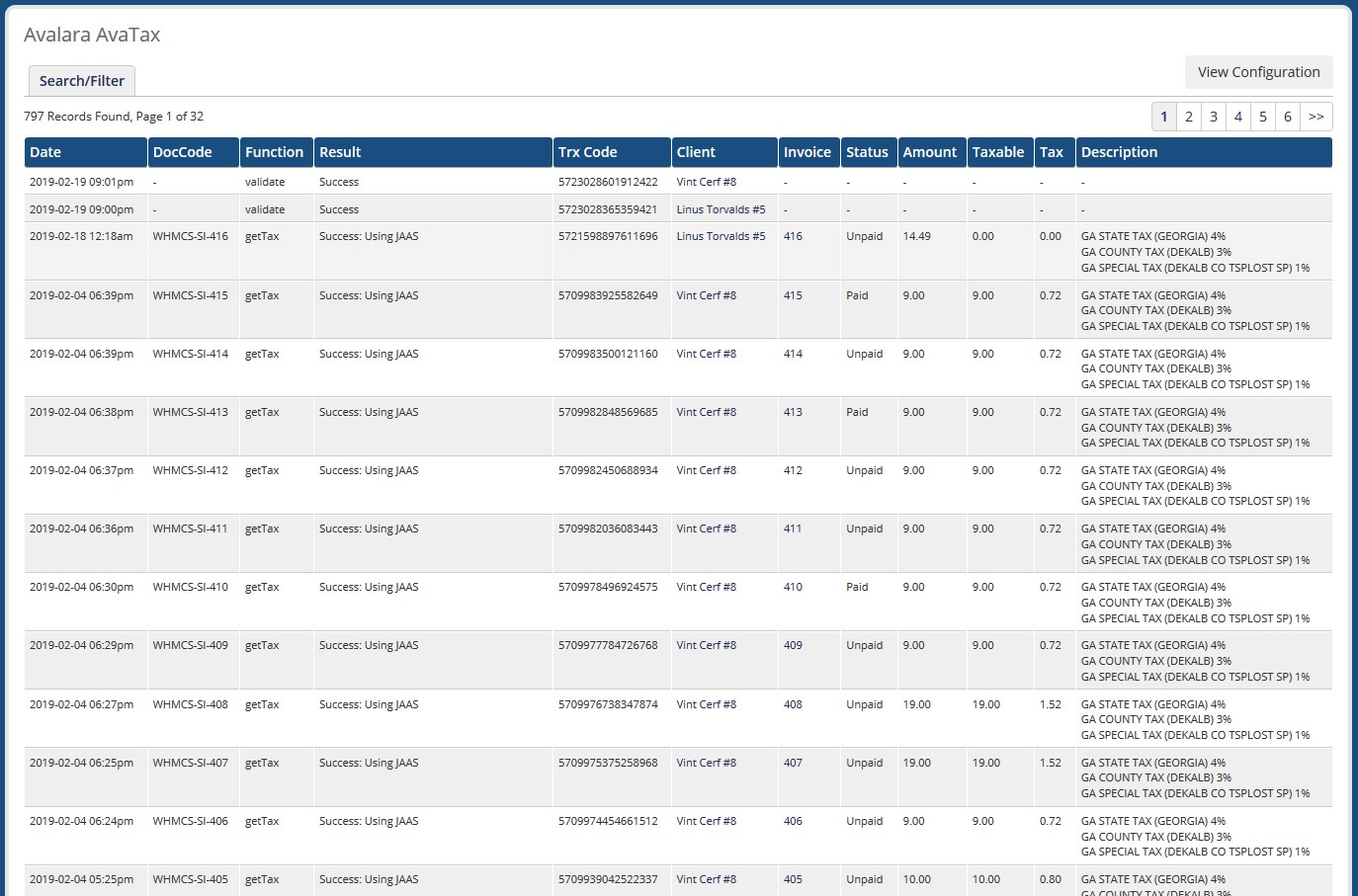

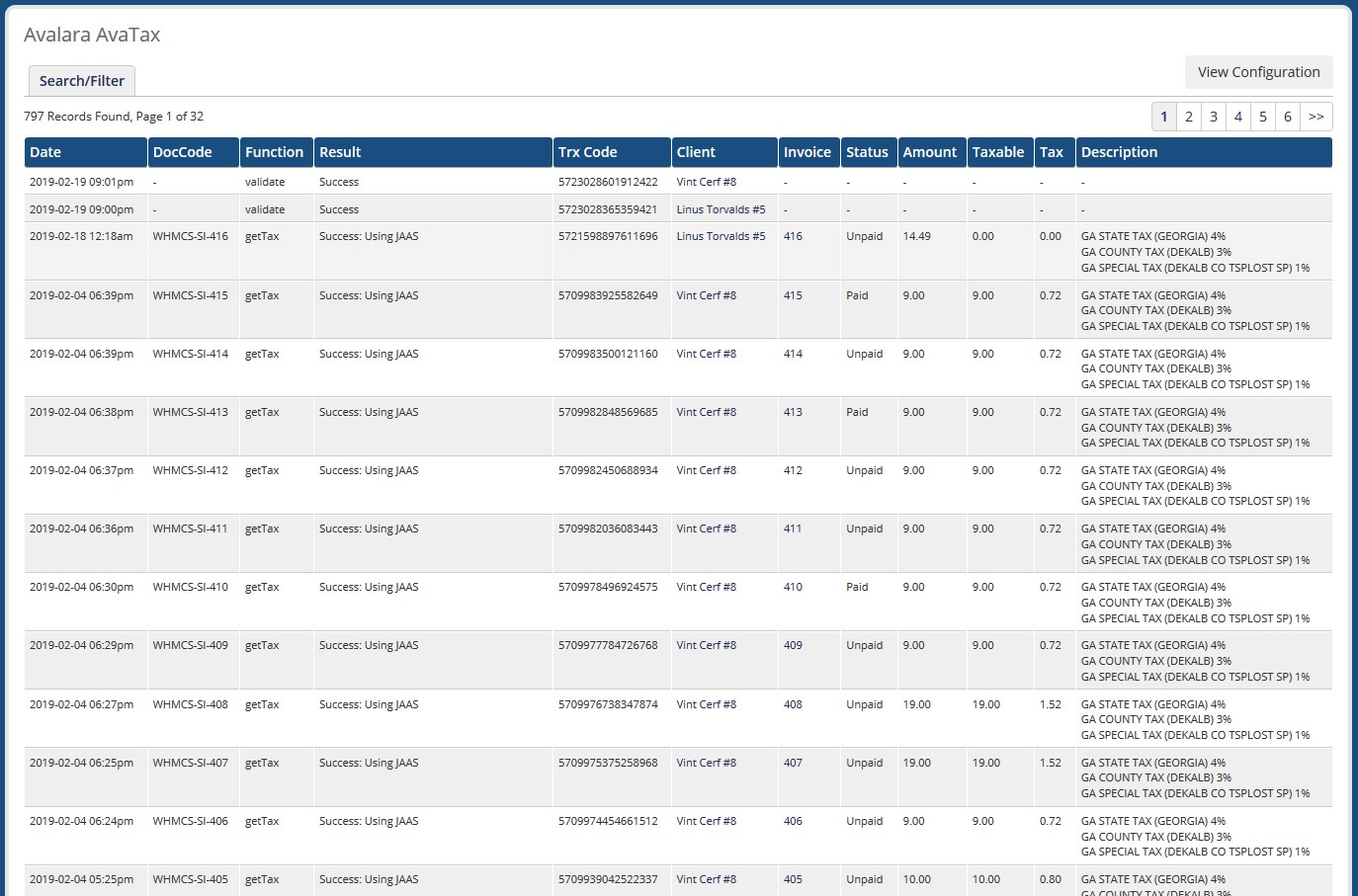

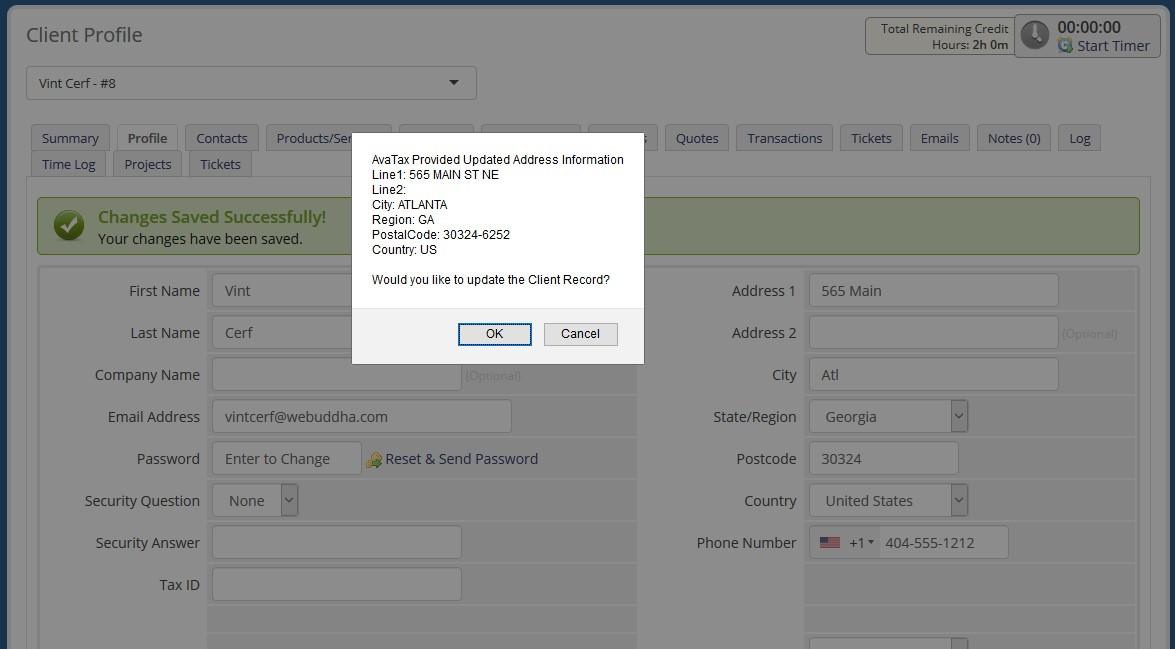

Wbavatax Avalara Avatax Tax Calcuation Integration Whmcs Marketplace

This makes them the wrong tool to use for determining sales tax rates in the United States.

. Find the average local tax rate in your area down to the ZIP code. Simply click on your state below and get the state sales tax rate you need. You can copy and paste from an Excel.

You can copy and paste a code you find here into the Tax Codes field in. 149 rows AvaTax for Communications supports tax calculation for a number of countries states territories and provinces. Base state sales tax rate 4.

Add up to 20 tax codes. New Tax Codes coming October 1 2013. Industrial production or manufacturers.

Local rate range 0-475. Due to varying local sales. In order to provide you with the most accurate sales tax calculations possible we are activating over 400 new tax codes as of.

You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell. Local rate range 0-5. The estimated 2022 sales tax rate for 82801 is.

This change was effective in Avalara products on April 1 2018. 77 rows Sales tax. Georgia state sales tax rate range.

The boundaries can change and often dont line up with tax rate jurisdictions. Ad Improve Compliance Reduce Risk and Spend Less Time Managing Sales Tax Changes. Theyre useful in states like.

Illinois state sales tax rate range. Base state sales tax rate 625. By basing sales tax.

Total rate range 625-11. AvaTax uses these values to identify tax jurisdictions and apply the correct tax. You can use this search page to find the Avalara codes that determine the taxability of the goods and.

Ad Improve Compliance Reduce Risk and Spend Less Time Managing Sales Tax Changes. Avalara is pleased to offer simplified state-specific sales tax rate details for your business and filing needs. Every tax jurisdiction in AvaTax is assigned a unique jurisdiction ID code and name.

Get a quick rate range. 25000 in physical products taxed at the general 625 rate. Select the states in which you do business.

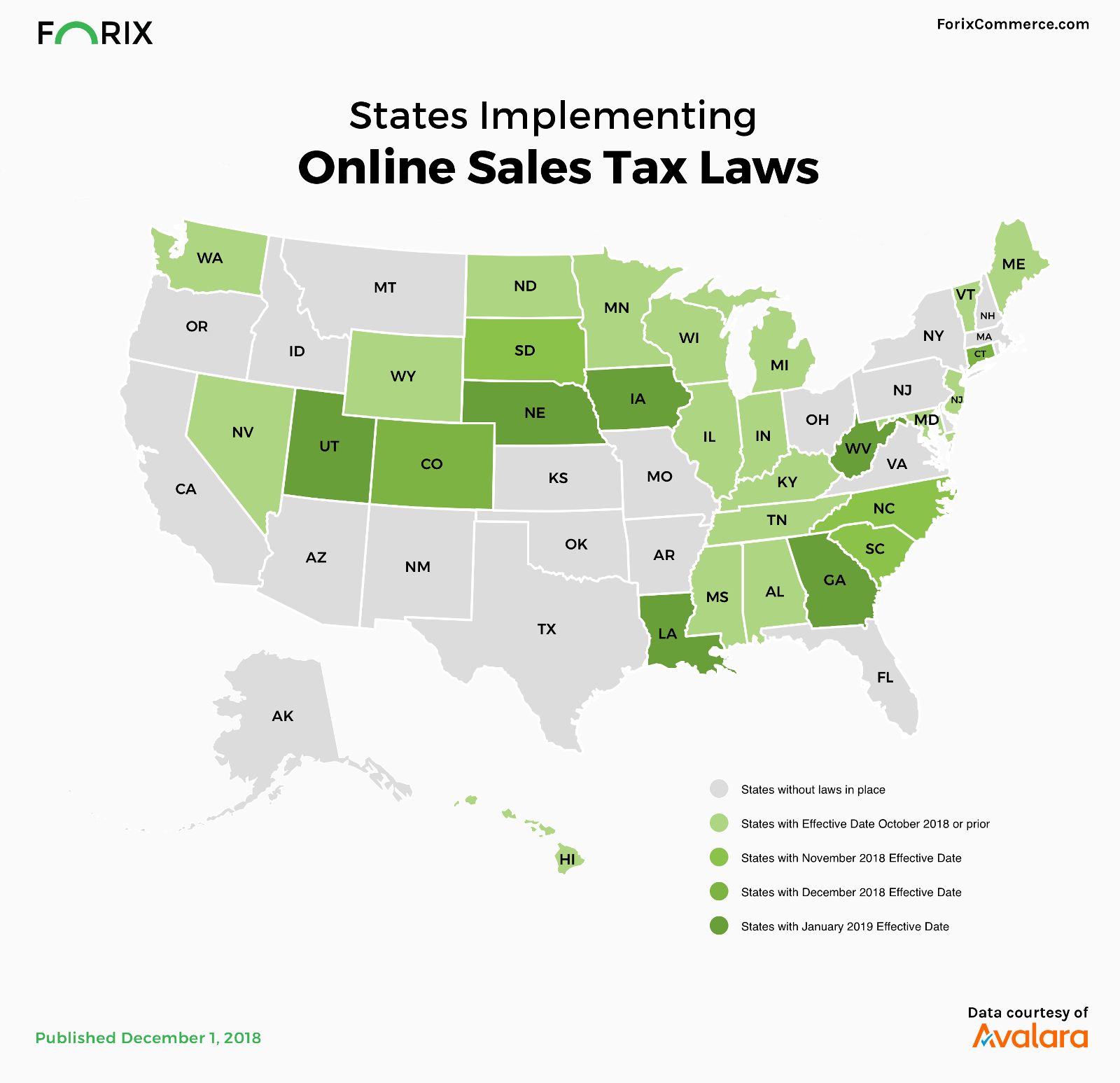

Find the Avalara Tax Codes also called a goods and services type for what you sell. Tax codes PM020704 and. The 2018 United States Supreme Court decision in South Dakota v.

You can either start typing and select from the list of available tax codes or paste the appropriate tax code. The general tax rate is 625 but food is taxed at a reduced rate of 10. Has impacted many state nexus laws and sales tax collection.

75000 in food taxed. We publish tables based on our latest. To ensure accurate tax calculation Avalara.

Link To Free Resources For U S Sales Tax Calculation 3182022 Drupal Org

Understand Sales Tax Holidays In Avatax Avalara Help Center

Wbavatax Avalara Avatax Tax Calcuation Integration Whmcs Marketplace

Understanding The Avatax For Communications Tax Engine Avalara Help Center

Wbavatax Avalara Avatax Tax Calcuation Integration Whmcs Marketplace

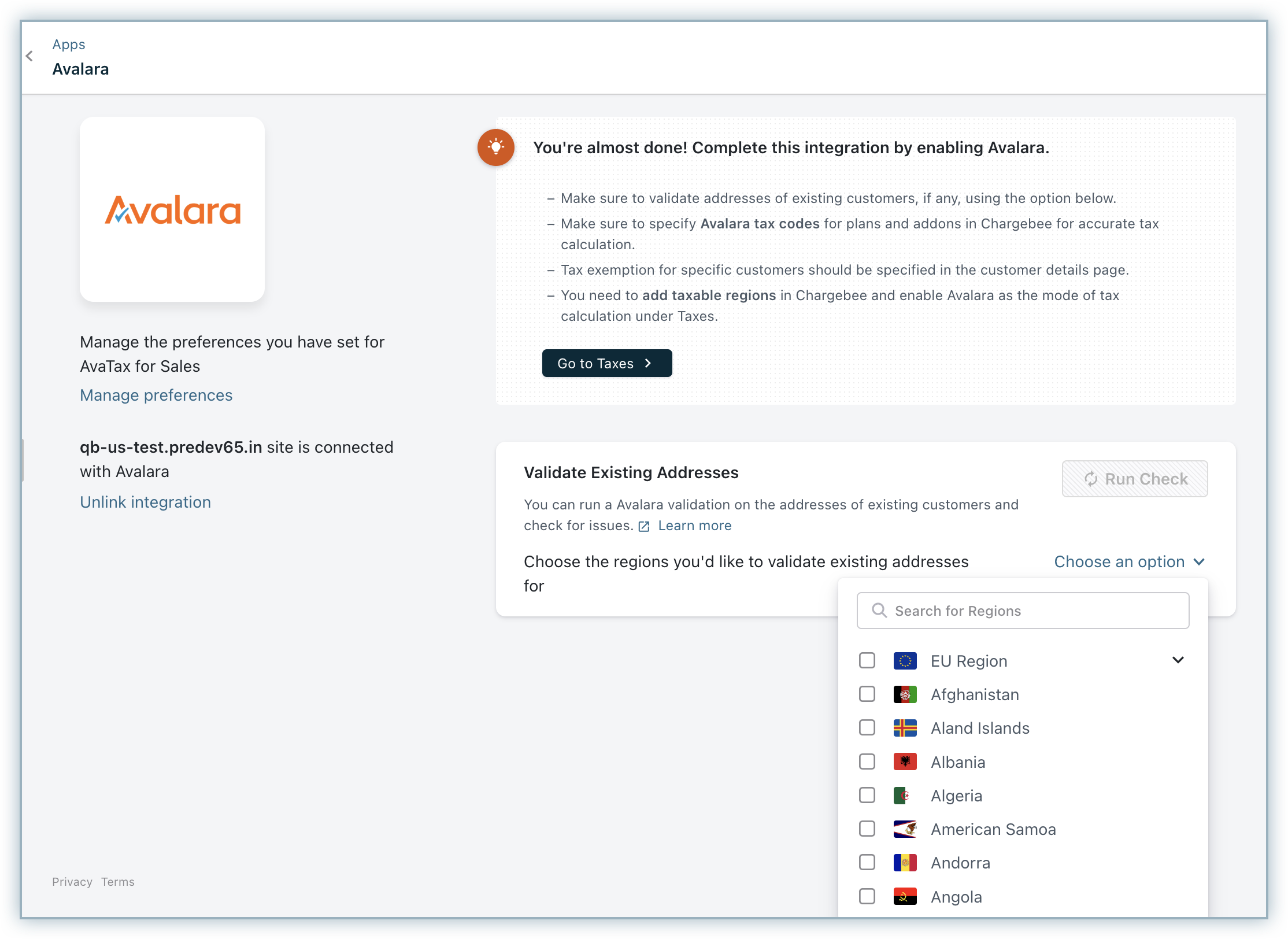

Avatax For Sales Chargebee Docs

View Of The Week Mid Week Edition On A Window Into The Future Tech Startups Start Up Plexus Products

6 Differences Between Vat And Us Sales Tax

How To Collect Sales Tax For Magento Websites Forix

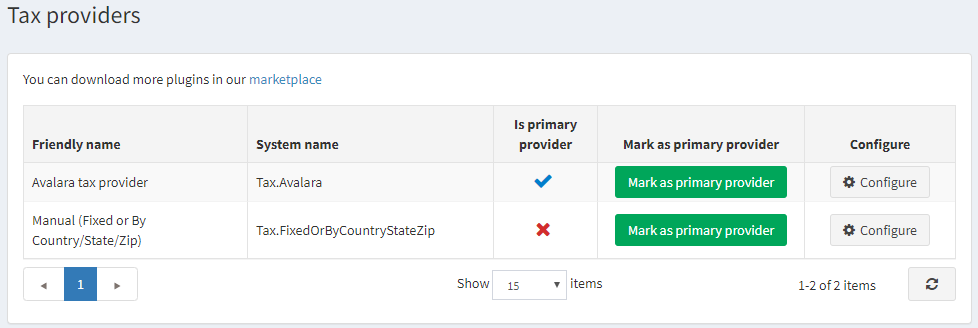

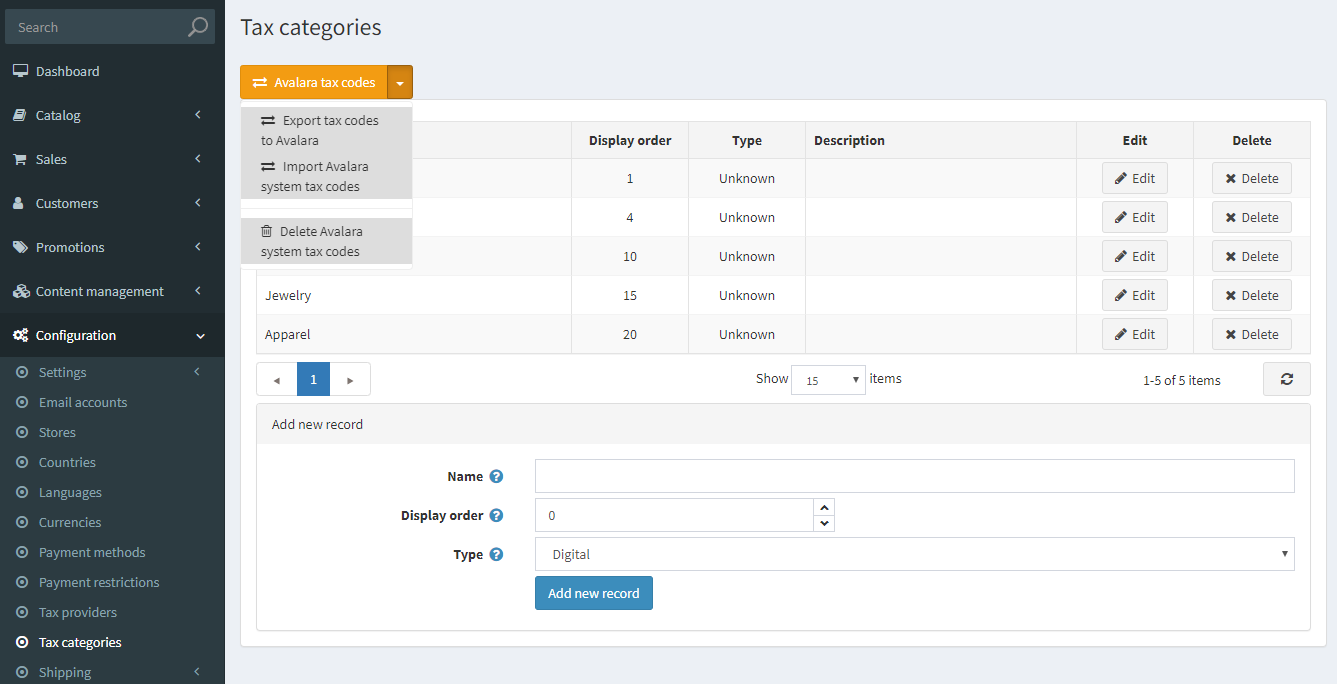

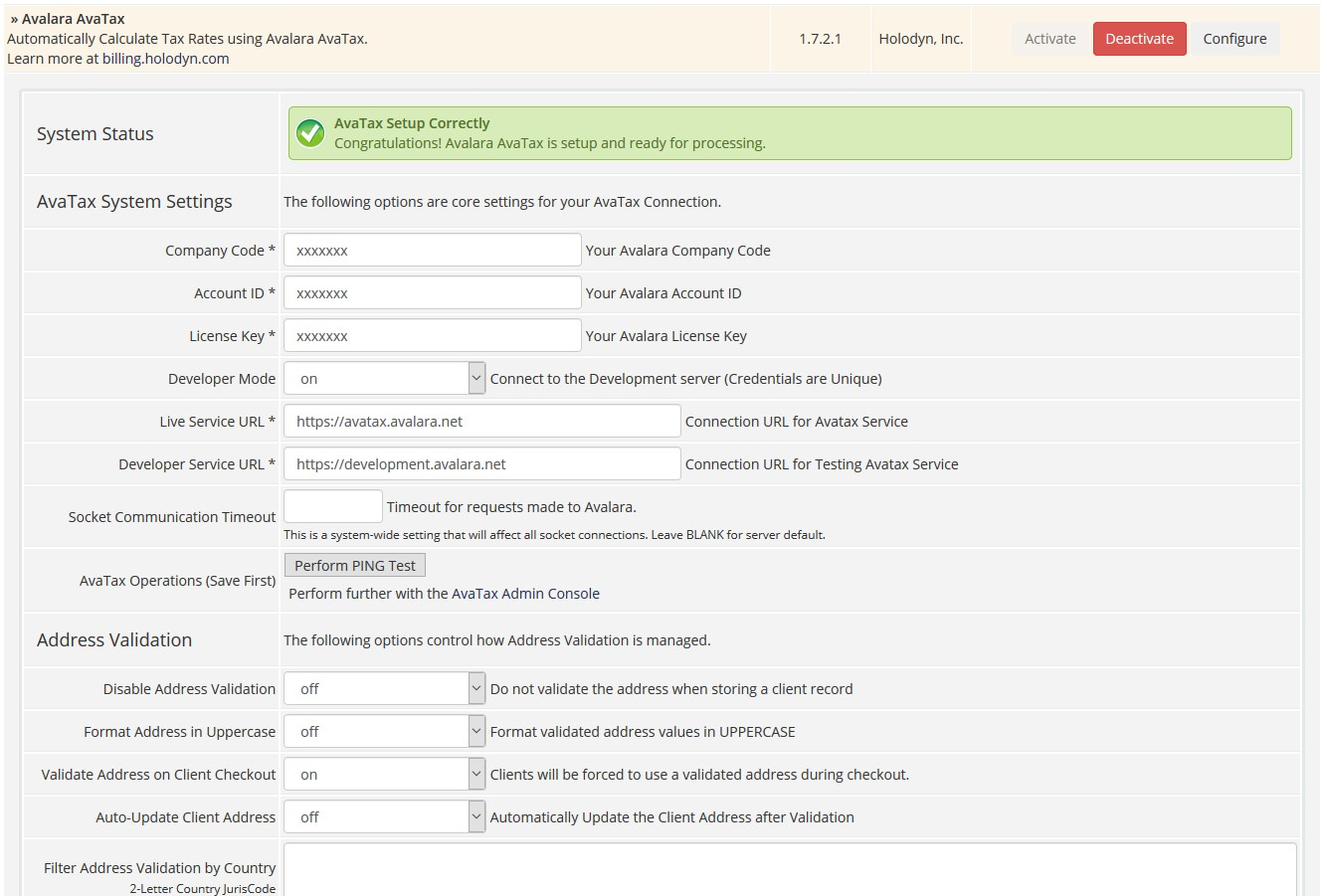

Configuration Of Taxation With Avalara Mr96

Software Sales Tax Use Tax Avalara

Avalara And Vertex Integration In Sap Business Bydesign Sap Blogs

Map The Items You Sell To Avalara Tax Codes Avalara Help Center